new orleans sales tax percentage

Board of Review 2021 Appeal Hearing Findings Board of Review 2021 Exhibit A- Appeal Report Resolution R-20-1 Resolution R-20-2 bOARD OF REVIEW 2022 REPORT BOARD OF REVIEW 2022 FINDINGS. Maine has a 55 general service provider and use tax raised temporarily until further notice from 5 on October 1 2013.

Spending The Evening Talking About State Sales Tax With The Vlaa Vlaa Regionalartscommission Taxes Iminovermyhead

Counties in New Mexico collect an average of 055 of a propertys assesed fair market value as property tax per year.

. Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year. New Orleans coterminous with. The table below shows the total state and local sales tax rates for all New York.

New York Sales Tax. The tax on lodging and prepared food is 8 and short term auto rental is 10. Taxpayers are encouraged to review and revise if needed the Employee Withholding Exemption Certificate Form L-4Taxpayers with income from sources other than wages should consider.

Alexander-Walker has struggled from the field this season shooting 375 and 311. 17 pick in the 2019 NBA draft but has had an up-and-down tenure with New Orleans. This means that depending on where you are actual rates may be significantly higher than other parts of the country.

New Mexico has one of the lowest median property tax rates in the United States with only eight states collecting a lower median property tax than. New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes. Tampa Florida decreased its sales tax rate by 1 percentage point to 75 percent earlier in 2021 when county commissioners voted to remove the 1 percent transportation tax that was approved in 2018.

If after the City Council in its capacity as the Board of Review renders a determination. At 4 New Yorks sales tax rate is one of the highest in the country. Louisiana bids out sales tax audits to private companies with many being paid on a percentage collected basis.

TAx commission Appeal links. Alexander-Walker was the No. However all counties collect additional surcharges on top of that 4 rate.

Due to the new state income tax rates and changes in the states withholding tables many Louisiana individual taxpayers can expect less tax withheld from their wages per pay period. The largest increases in the past two years came in Oxnard California 15 percent the Alameda County California cities of Fremont and Oakland 1 percent and Des. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000.

These are all officially. The median property tax in New Mexico is 88000 per year for a home worth the median value of 16090000. Orleans Parish tax Appeal Hearing Advisory.

Average Rental Rates For A One Bedroom Apartment In Los Angeles Ca Neighborhoods Apartment Rent R Moving To Los Angeles Los Angeles Apartments Los Angeles

Sure Sport Provides A Child With Physical Exercise And The Experience Of Being Part Of A Team But At What Infographic Make An Infographic Book Worth Reading

New Orleans Louisiana S Sales Tax Rate Is 9 45

What Is A Reverse Mortgage A Complex Financial Tool Reverse Mortgage Refinance Mortgage Refinancing Mortgage

Chatsworth Garden Water Fountain Garden Water Fountains Fountains Outdoor Stone Fountains

Louisiana Sales Tax Small Business Guide Truic

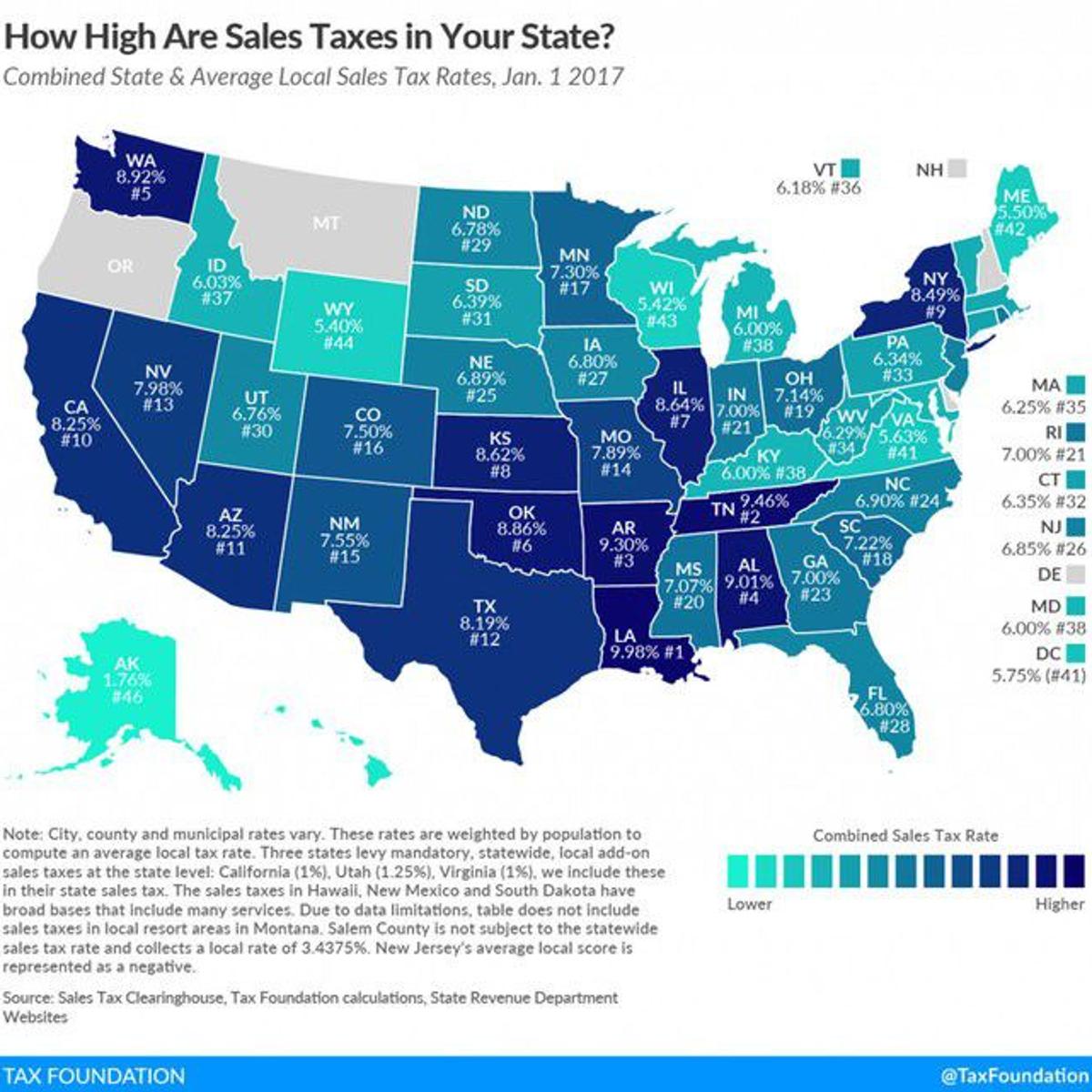

Louisiana Has The Highest Sales Tax Rate In America Business News Nola Com

All Umno Newspapers On The Slide Newspapers Daily Newspaper League